In the realm of financial speculation, a captivating question has emerged: Is Donald Trump teetering on the brink of bankruptcy? The intervention of insurer Chubb, who extended a timely loan to alleviate some of the former president’s escalating legal expenses. However, despite this intervention, Trump finds himself facing a staggering deficit of nearly half a billion dollars, adamantly asserting his inability to fulfill this financial obligation.

The spotlight is on the debt burdening former President Donald Trump—a daunting half-billion-dollar sum resulting from two significant legal judgments against him. The gravity of this debt escalates when considering Trump’s history of financial behavior, raising doubts about his willingness or capability to settle this substantial liability.

With revelations from The New York Times, unveiling Trump’s unsuccessful attempts to secure a loan from approximately 30 companies, emphasizing the practical impossibility of raising the necessary funds. Chubb has emerged as an outlier, offering Trump a lifeline in the form of a $91 million loan to secure his bond in the E. Jean Carroll defamation case.

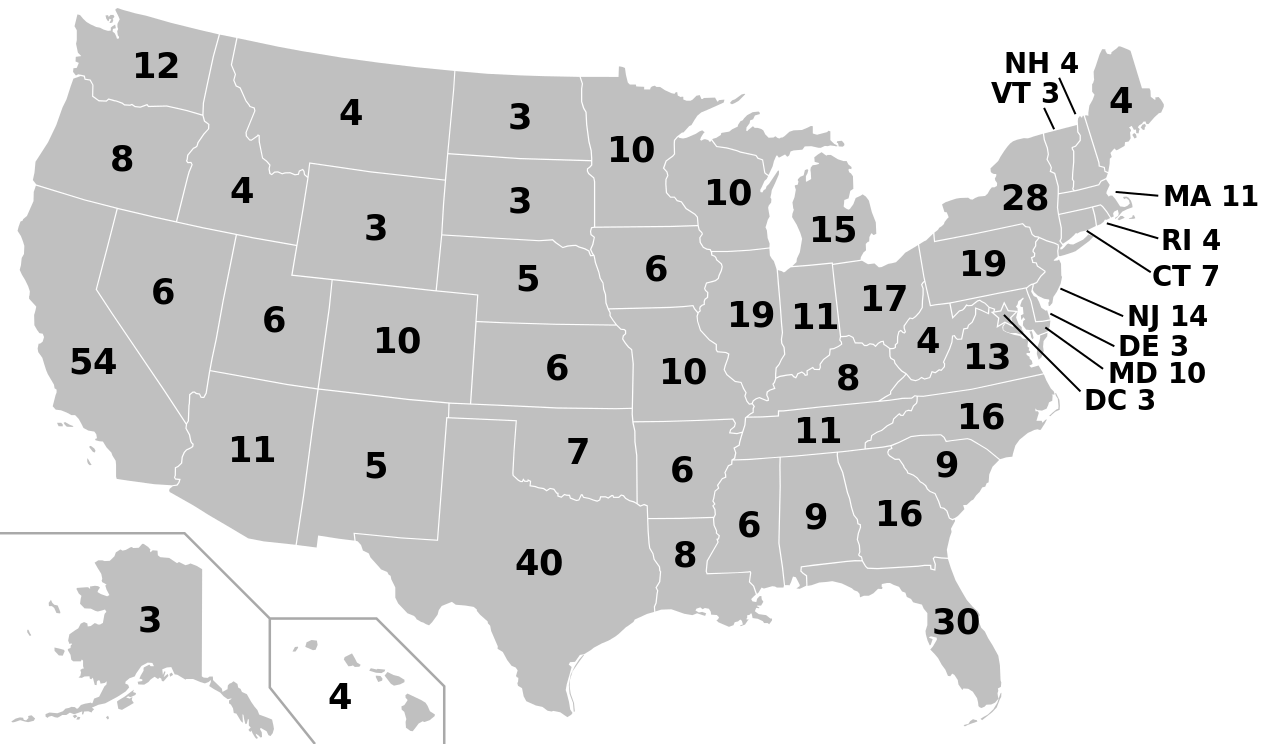

The first judgment, amounting to $83 million, stems from remarks on social media regarding Carroll, complementing an earlier $5 million judgment related to allegations of sexual abuse and defamation. The second, a staggering $355 million penalty for civil fraud, for Trump’s financial practices, is further exacerbated by accruing interest. As of February 16, the cumulative debt, including interest, stood at a staggering $539 million, constituting a significant portion of Trump’s purported wealth.

However, the financial woes extend beyond these two pivotal judgments, encompassing additional penalties and liabilities accrued from frivolous lawsuits and contempt fees. Trump’s financial predicament is exacerbated by looming audits of his tax returns and the exigency of maintaining substantial liquidity and net worth to comply with loan agreements—a challenge amidst his alleged hemorrhaging finances.

The specter of personal bankruptcy looms ominously, with parallels drawn to historical precedent and conjecture about the timing of such an eventuality—be it during a potential second term in office, amidst legal battles, or both. The prospect of asset seizure by the IRS adds another layer of urgency to Trump’s financial predicament, further complicating his already precarious position.

While Chubb’s CEO, Evan Greenberg, asserts the impartiality of the decision, emphasizing the company’s commitment to due process and risk management, doubts persist regarding potential political or regulatory influences. The nexus between Chubb and other entities, notably Aon, fuels conjecture about underlying dynamics and potential ulterior motives driving the insurer’s actions. However, options are running short as many companies have already denied Trump a bond.

List of Companies that Denied Trump Bond

Bond companies have stated that they “have never heard of such of a bond,” and companies were not interested in Trump’s real estate assets. The filing laid out a list of “some of” the sureties that had been contacted about the bond by Trump’s brokers, but which ultimately declined to back it. The list includes: Applied Underwriters (SiriusPoint), Allianz, Amynta, Arch, Argo, Ascot, AXA XL, Berkley, Berkshire Hathaway, CAP Specialty, Chubb, Cincinnati, CNA Surety, DUAL/Axis, Everest Re, Frankenmuth, Hartford, Hudson, IAT (Harco), Intact, Liberty, Munich Re, Philadelphia Indemnity, MainStreet (NGM), Markel, Nationwide, RLI, Skyward (Great Midwest), Sompo, Swiss Re, Tokyo Marine HCC, Travelers, and Zurich.

The New York attorney general said that regardless of Trump’s difficulty in securing the bond, her office is “prepared to make sure that the judgment is paid to New Yorkers” and suggested she would pursue asset seizure.

Leave a Reply