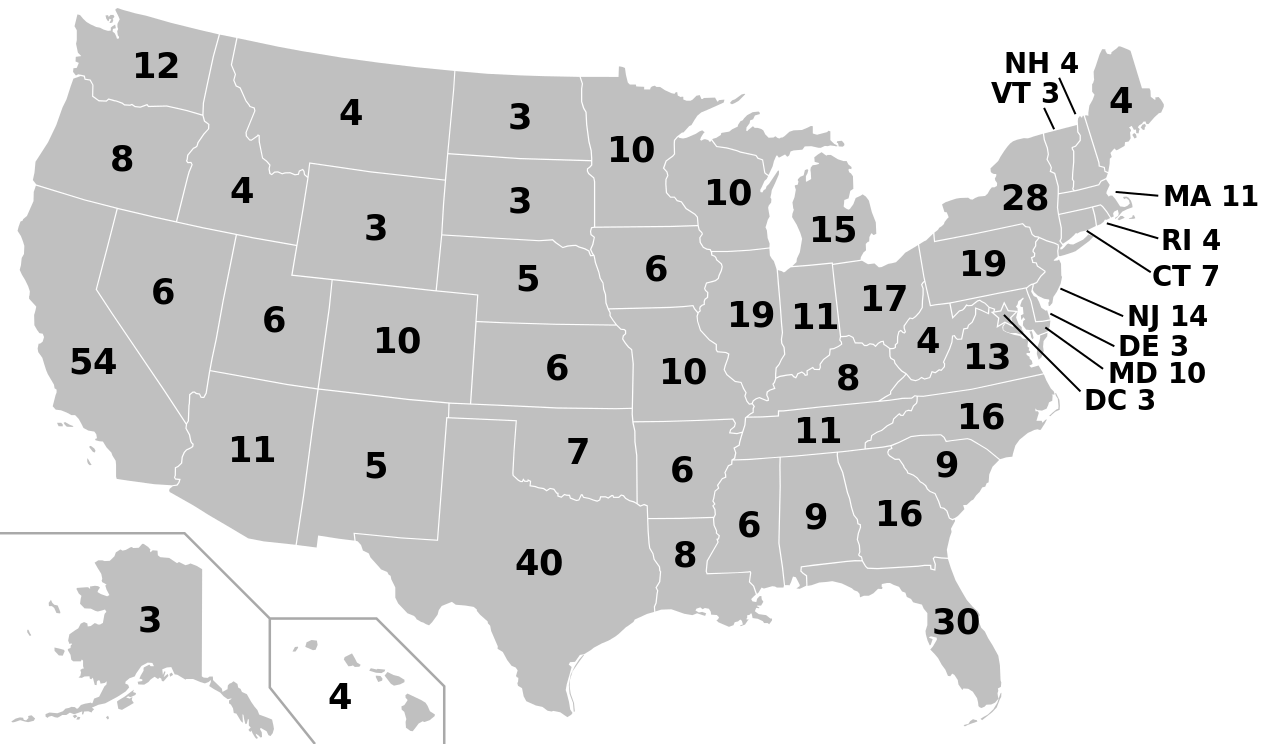

Binance, the largest cryptocurrency exchange globally, along with its founder Changpeng Zhao, is facing allegations of misappropriating investor funds, operating as an unregistered exchange, and violating multiple U.S. securities laws. The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit in the U.S. District Court for the District of Columbia, listing thirteen charges against the company. One of the charges involves the commingling and diversion of customer assets to an entity owned by Zhao named Sigma Chain. These accusations are reminiscent of practices revealed following the collapse of FTX, the second-largest cryptocurrency exchange, last year.

The lawsuit provides insight into the level of awareness the company’s owners had regarding the alleged legal violations. It cites a statement made by Binance’s Chief Compliance Officer in December 2018, where he candidly admitted, “we are operating as a f**king unlicensed securities exchange in the USA bro.” SEC Chair Gary Gensler, in a written statement, accuses Zhao and Binance of engaging in deceptive practices, conflicts of interest, lack of disclosure, and deliberate evasion of the law.

Gensler warns the public to exercise caution when investing their hard-earned assets on these unlawful platforms. Binance, in response, claims to have cooperated with the SEC’s investigation but criticizes the agency’s decision to pursue litigation unilaterally. The company asserts its intention to vigorously defend its platform, asserting that the SEC’s refusal to engage constructively reflects its misguided approach and reluctance to provide much-needed clarity and guidance to the digital asset industry.

This lawsuit follows the collapse of FTX eight months ago, which also faced accusations of commingling customers’ funds and investing them in high-risk ventures without their knowledge. In December, Sam Bankman-Fried, the founder of FTX, was charged by U.S. prosecutors and the SEC with money laundering, fraud, and securities fraud. His criminal trial is expected to take place in the fall.

Cory Klippsten, CEO of Swan Bitcoin, a bitcoin financial services company, comments that the SEC’s new complaint against Binance echoes longstanding claims made by individuals in the Bitcoin and crypto communities. He suggests that these practices by Binance have been widely known within the industry, making the charges unsurprising to those operating in the space.

This is not the first time that U.S. regulators have taken action against Binance. In March, the Commodity Futures Trading Commission filed an enforcement action against Binance and Zhao in the U.S. District Court for the Northern District of Illinois, accusing them of numerous violations. Additionally, Samuel Lim, Binance’s former chief compliance officer, is charged in the complaint with aiding and abetting the company’s violations.

Leave a Reply