The Internal Revenue Service (IRS) has revealed its plan to conduct a trial of a complimentary tax filing service in 2024. This service, known as Direct File, will be available to a select group of fortunate taxpayers across potentially 13 states. The introduction of Direct File serves as a direct challenge to paid tax preparation services like TurboTax and H&R Block, which have long been reluctant to offer free and user-friendly tax filing options.

“This is a critical step forward for this innovative effort that will test the feasibility of providing taxpayers a new option to file their returns for free directly with the IRS,”

IRS Commissioner Danny Werfel

The program can be attributed largely to the funding allocated by the 2022 Inflation Reduction Act, which specifically designated $15 million for the development and implementation of a user-friendly government-backed tax filing service that is accessible to all at no cost.

The Internal Revenue Service (IRS) has been developing a pilot program over the past 18 months within the business domain. They view this program as an additional option in the range of tax filing methods, which includes self-managed Free File, commercial tax software like TurboTax, and professional tax preparation services. This information is aimed at a knowledgeable audience and is presented in a neutral and informative manner.

The Internal Revenue Service (IRS) defines Direct File as a user-friendly service designed for individuals with straightforward tax situations involving W-2s and typical income deductions and credits. It is accessible on mobile devices and is offered in both English and Spanish. The exact nature of these interviews, whether conducted by humans or automated systems, remains uncertain. However, it is expected that the IRS will make modifications based on feedback received during the pilot program’s limited rollout.

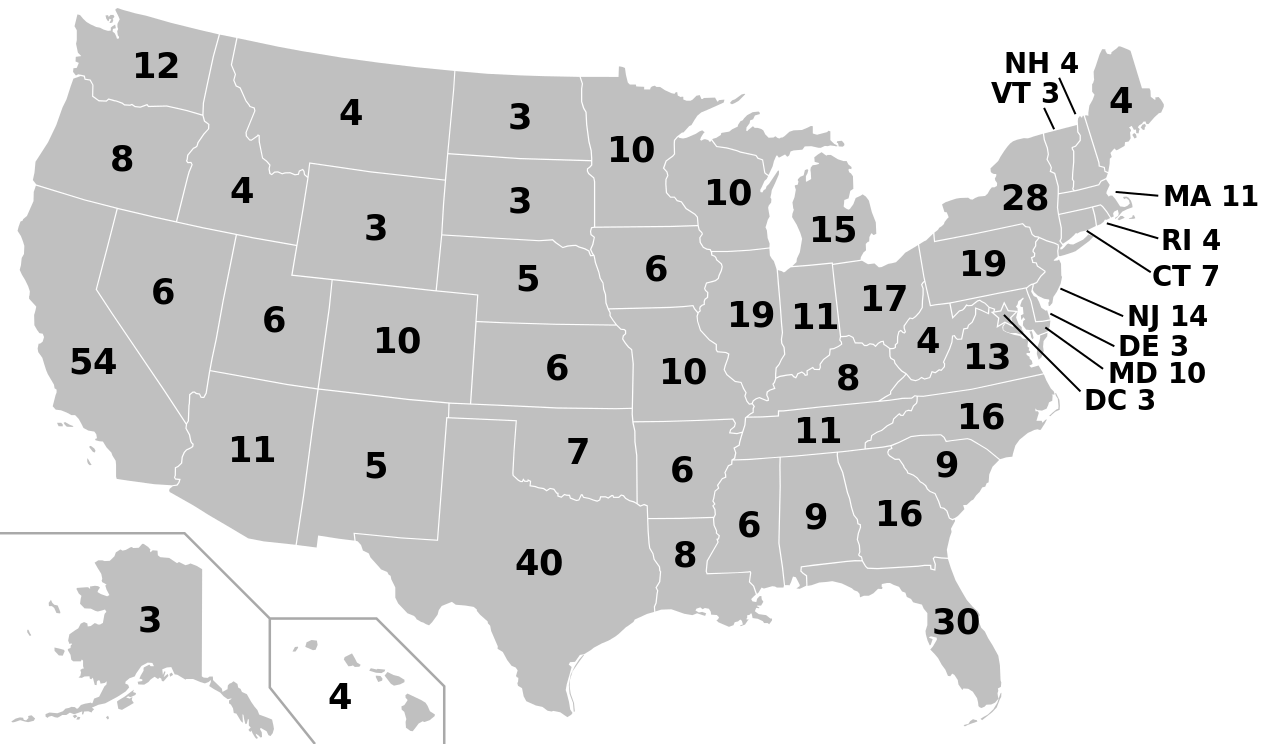

The integration of Direct File for the 2024 tax year includes four states: Arizona, California, Massachusetts, and New York. These states have actively decided to participate in the program. Additionally, states like Alaska, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming may also be eligible to join, as they do not have state income tax. However, the final decision has not been made yet. It is important to note that while every state had the opportunity to participate, not all were able to do so.

In certain states, a select group of people with uncomplicated tax returns will be given the chance to utilize Direct File. This will enable the IRS to assess the pros and cons as well as the practical difficulties that come with offering taxpayers a voluntary Direct File option. It can be compared to an alpha version in the realm of software development.

Intuit and similar companies, who have been covertly opposing easy, cost-free, and transparent tax filing for a considerable period of time, are looking how to maintain market share amidst free offerings.

Leave a Reply