The bill, officially known as HB 133, has sparked controversy due to its potential implications for tenants in Florida. Under this new law, landlords are permitted to charge tenants recurring fees instead of traditional security deposits, which critics have labeled as “junk fees.” These fees are nonrefundable and have no limit, raising concerns about potential abuse by unscrupulous landlords.

Supporters of the bill argue that it offers tenants an alternative to paying large upfront security deposits, which can be a significant financial burden in Florida’s highly competitive rental market. Proponents include corporate lobbying interests, such as the Florida Apartment Association, as well as property tech companies like Rhino and LeaseLock. They contend that these recurring fees provide flexibility to tenants, enabling them to avoid the hefty initial costs associated with security deposits.

However, critics of the legislation, including social advocacy groups and labor unions like the Service Employees International Union, warn that the bill exposes vulnerable renters to predatory practices. Jay Mobley, an attorney for the Orange County Legal Aid Society, emphasized the potential for abuse by “bad landlords” under this new law. With no limits on the fees that landlords can charge, tenants may face exorbitant recurring charges that could accumulate over time.

One of the key concerns raised by opponents of the bill is the lack of tenant protection. Unlike security deposits, which cover a tenant’s liability for property damage, these recurring fees offer no such coverage. Critics argue that unless landlords choose to purchase an insurance policy, which primarily benefits them, tenants would be left responsible for all damages without any potential for reimbursement.

Despite efforts by Democrats to amend the bill and introduce stronger safeguards for tenants, their attempts were unsuccessful. Several Florida Democrats even joined Republicans in voting in favor of the bill’s passage, demonstrating a division within the political landscape.

“It’s not designed to protect the tenant at all”

Attorney Jay Mobley

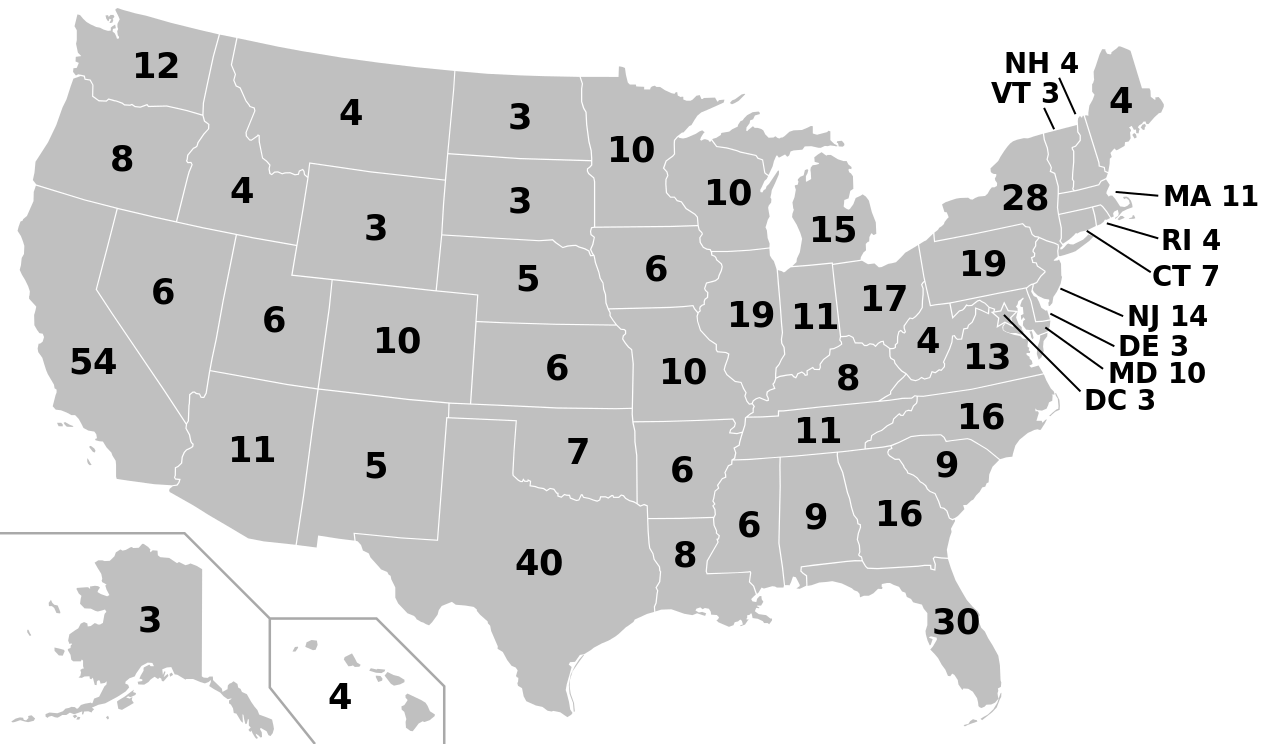

Governor DeSantis’s decision to sign this controversial bill comes at a time when his actions as governor are facing increased scrutiny. Furthermore, the governor’s recent announcement of his 2024 presidential campaign adds another layer of interest to his decision-making process.

A similar bill, which Leaselock lobbyists contributed to drafting before the start of the 2022 legislative session, shares resemblances with the current legislation.

Although it failed to pass last year, the bill was revived during this year’s session and underwent streamlining by Republican leaders in the House. It was referred to only two committees instead of the usual three.

LeaseLock, a company that provides alternatives to security deposits for landlords and tenants, has actively advocated for similar laws at both local and state levels in various regions.

However, LeaseLock faced scrutiny in Maryland last year over concerns regarding potential violations of the state’s consumer protection laws. As a result, the State Attorney of Maryland reached a settlement with the California-based company, effectively preventing them from offering such “alternatives” to landlords.

In response to criticisms, Florida’s HB 133 does not impose a mandatory requirement for landlords to provide the security deposit alternative. Florida Representative Jim Mooney, a Republican who sponsored the bill, argued that it is a choice for landlords rather than a mandate.

Florida’s HB 133, signed into law by Governor Ron DeSantis, has sparked intense debate surrounding tenant rights and the potential exploitation by landlords. While supporters argue that the bill offers tenants an alternative to upfront security deposits, critics contend that it exposes vulnerable renters to predatory business practices. As the impact of this bill unfolds in Florida’s rental market, the efficacy of the alternative security deposit system and its implications for tenants will be closely monitored.

Leave a Reply