The recent BRICS summit held in South Africa concluded without introducing a new currency challenging the supremacy of the US dollar. The summit, which included Brazil, Russia, India, China, and South Africa as its core members, expanded its reach by welcoming Saudi Arabia, Iran, Ethiopia, Egypt, Argentina, and the United Arab Emirates. This expansion marks a significant move in BRICS’ efforts to establish itself as an alternative to Western-led alliances.

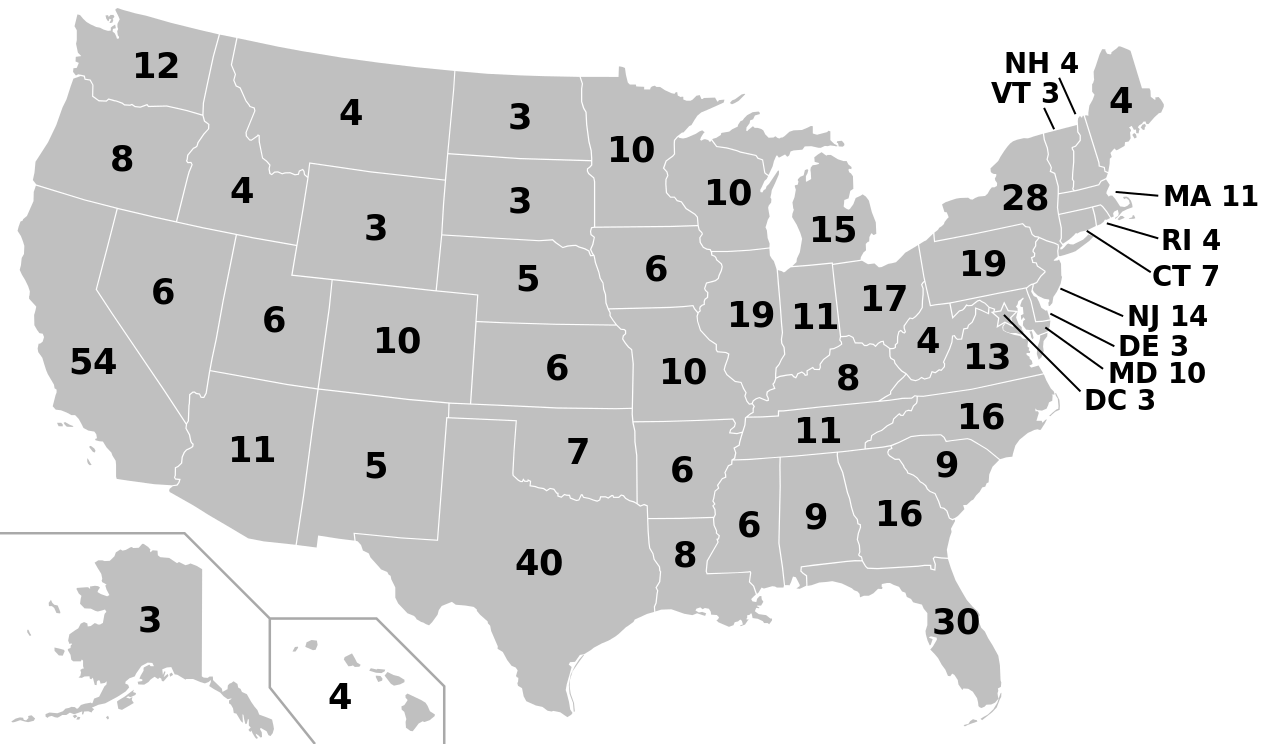

De-dollarization, a topic of global economic interest, took center stage during the summit. However, the member nations exhibited divergent opinions, emphasizing the complexity of the issue and the potential delays in any substantial currency development. As this discourse unfolded, SWIFT data revealed that the US dollar maintained its dominance, being used for a record 46% of foreign exchange payments in July.

In this comprehensive exploration, we delve into the intricacies of the BRICS summit, the perspectives of each member nation’s leadership on de-dollarization, and the challenges and opportunities in reducing the global reliance on the US dollar.

Brazil’s Push for a Common BRICS Currency

Brazil’s President, Luiz Inacio Lula da Silva, emerged as a prominent advocate for an alternative trade settlement currency within the BRICS bloc. He emphasized the benefits of creating a common currency for trade and investment transactions among BRICS members, aiming to expand payment options and reduce vulnerabilities. Lula da Silva’s strong stance on alternative currencies has been consistent, raising questions about the dollar’s preeminence in global finance.

Russia’s Irreversible Pursuit of De-Dollarization

Russian President Vladimir Putin reiterated the importance of increasing the use of local currencies for trade within the BRICS bloc. He emphasized the “irreversible” nature of de-dedollarization within the group and its accelerating pace. Putin’s commitment to promoting trade in local currencies comes as Russia faces sweeping sanctions that have driven the country away from the US dollar-dominated global financial system.

India’s Realism Amid De-Dollarization Aspirations

Hardeep Singh Puri, India’s oil and gas minister, expressed the desire for the Indian rupee to assume a leading role on the global stage. However, he also emphasized the challenges of overturning longstanding payment arrangements. Puri, a realist, acknowledged the entrenched nature of international arrangements for trade and payment, highlighting the complexities of transitioning to an alternative global currency.

China’s Call for Reform in Global Finance

While China did not explicitly comment on the idea of a common BRICS currency, President Xi Jinping underscored the need for reform in the international financial and monetary system. China’s ambition for the Chinese yuan to play a significant global role became evident, even though it did not advocate for replacing the US dollar.

South Africa’s Stance on BRICS Currency

South Africa’s finance minister, Enoch Godongwana, dismissed the notion of a common BRICS currency. He argued that setting up such a currency would entail the establishment of a central bank, potentially leading to a loss of monetary policy independence—a stance that reflects South Africa’s cautious approach to monetary integration. Instead, the country appears inclined to boost intra-BRICS trade in local currencies, a strategy aimed at reducing reliance on the US dollar.

The Critique from BRICS Architect, Jim O’Neill

Jim O’Neill, the economist who coined the term BRICS, expressed skepticism about the idea of a common BRICS currency. He deemed the notion “ridiculous” and questioned the feasibility of creating a BRICS central bank. O’Neill highlighted the political differences between China and India as a major obstacle to de-dollarization and noted that agreement between these two nations could pose a substantial challenge to the dollar’s dominance.

Conclusion

The BRICS summit’s discourse on de-dollarization unveiled a spectrum of perspectives among its member nations, ranging from enthusiastic support to cautious realism. Despite the lack of consensus on a new currency, this dialogue underscores the ongoing global shift away from the US dollar. It remains to be seen how these diverse viewpoints will shape the future of international finance and the potential emergence of alternative currencies within the BRICS bloc and beyond.

Leave a Reply