Bank of America Penalized $150 Million for Unethical Practices, Including Fabricated Accounts and Unauthorized Fees

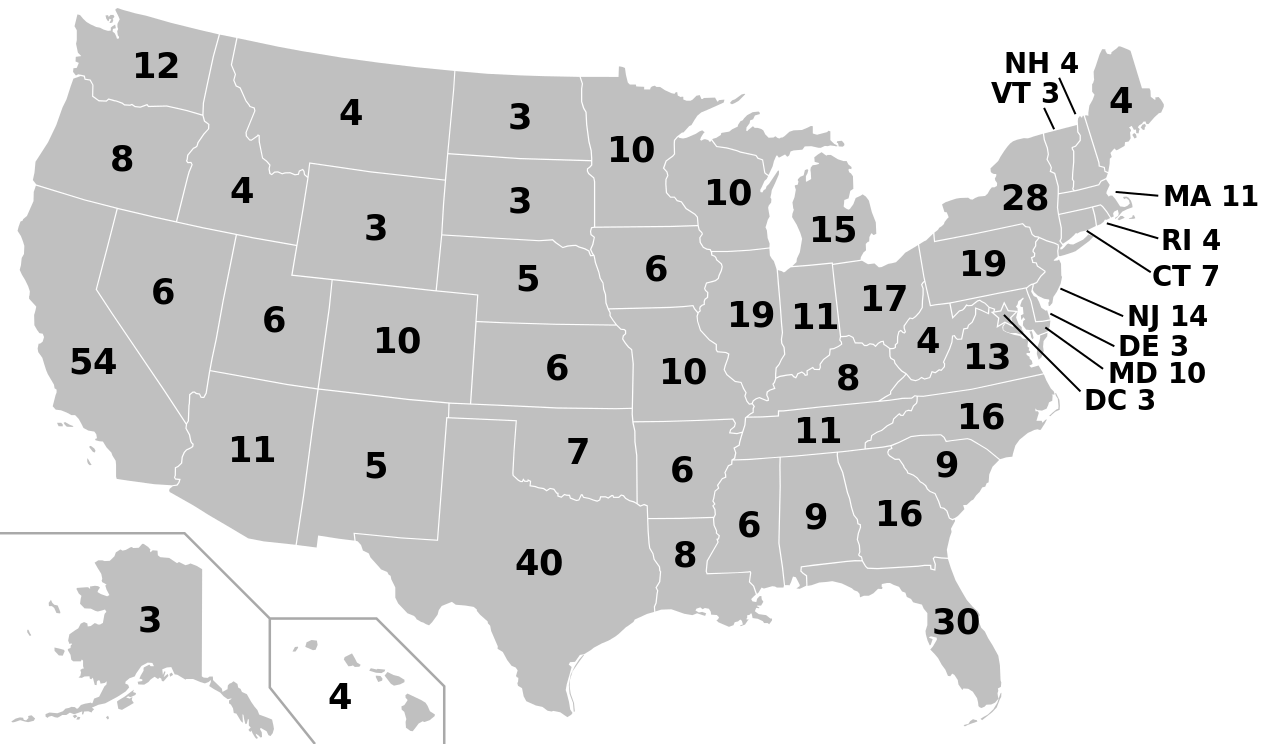

Bank of America, the second-largest financial institution in the United States based on assets, has been involved in fraudulent activities that negatively impacted a significant number of its customers, according to the Consumer Financial Protection Bureau’s announcement on Tuesday.

The Consumer Financial Protection Bureau (CFPB) stated in a release that the bank imposed numerous overdraft fees amounting to $35 for a single transaction. Additionally, they neglected to accurately distribute rewards to credit card holders and enrolled customers in card accounts without obtaining their consent.

Bank of America, headquartered in Charlotte, North Carolina, has been instructed to pay a combined sum of $150 million in fines to the CFPB and the Office of the Comptroller of the Currency, another regulatory body. Moreover, it is obligated to compensate customers who were unfairly subjected to unjustified fees, totaling approximately $80.4 million. This additional amount is in addition to the $23 million that Bank of America has already refunded to customers who were wrongly denied card rewards.

The CFPB Director, Rohit Chopra, emphasized “These practices are illegal and undermine customer trust,” CFPB Director Rohit Chopra said in the release.”

Bank of America representative Bill Halldin stated that the bank made a conscious decision to lower overdraft fees and completely eliminate non-sufficient fund fees during the first six months of 2022. As a result, their revenue from these fees decreased by a significant 90%.

The recent announcement on Tuesday indicates further evidence of the questionable practices brought to light by Wells Fargo.

The scandal involving fake accounts in 2016 extended beyond the boundaries of just one bank.

U.S. Bank, along with Wells Fargo, has faced regulatory repercussions due to their sales-oriented culture, resulting in the creation of millions of fraudulent accounts.

Last year, the company faced a penalty of $37.5 million for enrolling customers in accounts without their authorization.

Leave a Reply